Three Ways to Keep Your Payment Information Safe

It is no secret that cybercrime is on the increase. Banks and security services are working hard to eradicate it, yet criminals are at the forefront of innovation when it comes to scamming people out of their money. This is mainly done through acquiring payment information and fraudulently transferring balances or making transactions. Below, we discuss three ways to keep your payment information safe.

1 - Consider Your Payment Methods

How you pay can be vital, and many people are now choosing to pay using credit cards alone. The reason for this is that it takes longer to process, and thus can be spotted and cancelled easier. If the transaction is in dispute, you have more chance to keep your money than if it is instantly transferred. Make sure you only share your information with companies that use known payment gateways like Mastercard and Visa and have a green padlock in the top corner to show they are encrypted.

In some industries, you may even find that the ability to deposit with a mobile phone is making a comeback. This was a feature in the early days of cellphones, where you would make a purchase and the money would be taken from your pay-as-you-go account or added to your monthly bill. Industries and sectors like the leading online casinos have started to use this, both for its ease of use and security. You can now deposit with mobile casinos on websites like MrQ and still enjoy all the breadth of games and services that others enjoy while benefiting from generous signup bonuses.

2 - Protect Your Own Information

It is not enough to leave your bank in charge of your information and its protection. You must actively do this yourself. As they have security teams, fraudsters are much more likely to target individuals.

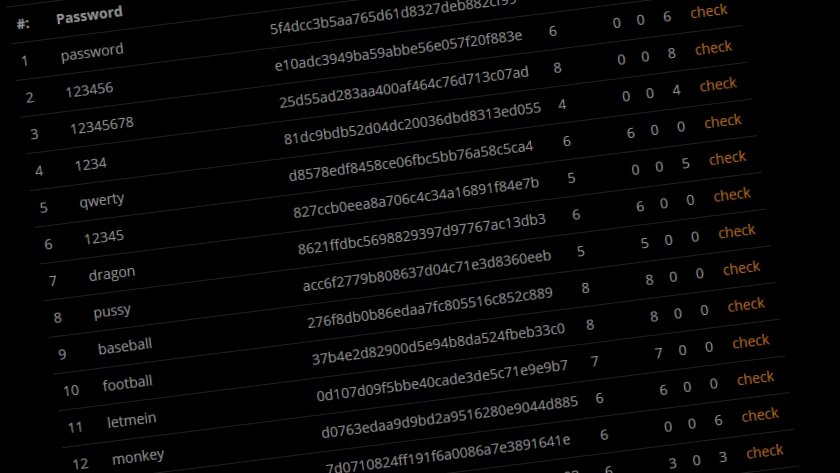

A good place to start is with your password. Make sure it is a mix of characters, letters, and numbers. Try to use an individual password for each account, and don't use information that can be gleaned from social media for it. For example, avoid the names of pets, family members, and similar.

You should then make sure you enable two-factor authentication, so codes get sent to your mobile when you make log-ins or transactions. These numbers, along with your pin, should never be given to anyone, even if they purport to be from a financial institution.

3 - Know What to Do When Fraud Does Happen

When a breach of your data does occur, it helps to know what to do right away. The longer you leave it, the more money could be taken or more information could be seized. Make sure you ring your bank and cancel your cards immediately, and get any accounts frozen. You should then change all your passwords. You may also wish to file a police report about the incident.

Make sure you check your bank statements regularly. If not, money could be leaving your account without you even noticing. By using these tips it should help you stay secure and minimize the damage if any unauthorized transactions do occur.